Blog

The following content makes for some good light reading. But if you're after something a little juicier, check out Jeremy's Expert Busting Series.

|

|

|||

|

Getting hot spots wrongOne industry body's hot-spot report should be read as a NOT-spot report by investors... read more |

||

|

|

|||

|

Worst Financial AdviceI read a blog titled, 'The 6 biggest property investment myths'. You won't believe... read more |

||

|

|

|||

|

How to counter property spruikers - educatorsProperty spruikers may take a number of forms, disguising themselves as professionals... read more |

||

|

|

|||

|

Brisbane still no-grow-zone8 months ago I'd had a gutful of hearing that Brisbane is the next growth city and that... read more |

||

|

|

|||

|

Cash-Flow vs. Cap-GrowWhen should cash-flow be the primary focus of an investor? How important is capital growth?... read more |

||

|

|

|||

|

Warren Buffet is not GodWarren Buffet is not God. He is a human that makes mistakes like the rest of us... read more |

||

|

|

|||

|

What's your time worthShould property investors wash and iron their clothes or get them dry cleaned?... read more |

||

|

|

|||

|

Murphy report wrong - supply bunkumMore supply won't improve affordability, a report suggests. Bunkum!... read more |

||

|

|

|||

|

3 reasons to research AFTER buyingThree reasons to research a suburb AFTER you've just bought there... read more |

||

|

|

|||

|

No such thing as too hot"Too hot", "Overheated" - clich?s that make no sense. Capital growth noobs need to get this straight... read more |

||

|

|

|||

|

Demographic DeceptionsYou may have heard, "Don't buy units in a suburb dominated by big families". It sounds wise but is misleading... read more |

||

|

|

|||

|

State of Origin - Brisbane vs SydneyThere's a lot of talk that investors should target Brisbane now instead of Sydney. I found a really good indicator that... read more |

||

|

|

|||

|

New vs old growth driversHands up if you've ever heard a so-called expert claim some of the following as growth drivers... read more |

||

|

|

|||

|

Desperate for capital growth driversSometimes developers get desperate to find reasons why capital growth will take place in suburbs they've just built in... read more |

||

|

|

|||

|

Do high earners push prices?Ever heard an expert recommend suburbs where high income earners live? Wanna be smarter than an expert?... read more |

||

|

|

|||

|

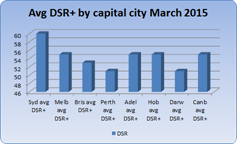

Where to after Sydney?Is Brisbane really going to take over Sydney's growth top spot in 2015? The DSR reveals some surprises... read more |

||

|

|

|||

|

The research revolutionThe way we research property locations is changing. New statistics are now available giving investors... read more |

||

|

|

|||

|

|

The great population growth mythNot only is population growth the most overrated indicator of capital growth, but amazingly it can be an indicator of negative capital growth... read more |

||

|

|

|||

|

Misleading mediansMany investors blindly look at median prices not realising how misleading they can be. I remember getting into trouble... read more |

||

|

|

|||

|

I want cake now!There's been a lot of mouthing off about how hard it is for 1st home buyers (FHB) to get into the market. I think I know what one of the problems might be... read more |

||

|

|

|||

|

Areas always in demandIs it really possible to find areas that are always in demand? We need to understand what demand means... read more |

||

|

|

|||

|

Abolishing negative gearing won't solve the problemGetting rid of negative gearing won't solve the affordability crisis. Long term it won't hurt investors either... read more |

||

Education

|

Buying under market value (YIP mag April 2013): This article highlights the "gotchas" of trying to buy under market value. It was one of the favourites of the editor of Your Investment Property magazine. Every second investor and their cuz reckon they've bought under market value. But most don't even realise they didn't. Jeremy Sheppard points out the cases when this strategy can actually be dangerous. Forewarned is forearmed. |

||||||||

|

|

||||||||

|

To sell or hold (YIP mag May 2013): Whether to sell or hold is actually quite simple. It all comes down to recycling costs versus opportunity costs. There's only one tricky part - estimating future capital growth. Jeremy Sheppard explains the concept and maps out the considerations to make the decision unemotional and objective. He also tackles the awkward topic of esimating capital growth. |

||||||||

|

|

||||||||

|

Statistical versus fundamental research (YIP mag April 2012): Jeremy Sheppard explains the difference between statistical and fundamental research. This article highlights the pitfalls and benefits of each. The article is not so much in favour of one method of research over the other. It is more a case of knowing when to use which method.

|

||||||||

|

|

||||||||

|

High-speed research technique (YIP mag May 2012): This article shows a way in which investors can get their teeth stuck into research without the time-kill. There is some research that is time-consuming and beneficial and other research that is just time-consuming. Jeremy Sheppard shows how to get the best dime for your time. Technology is making research more effective and faster. |

||||||||

|

|

||||||||

|

Investing on a low income (YIP mag June 2012): It's not easy getting into property investment on a low income. But it is possible. Jeremy Sheppard gives some specific tips on how to go about it for those on a tight budget. He also shares a few quick points about insurance, property management, fixed vs variable loans and depreciation. |

||||||||

|

|

||||||||

|

Are low deposit loans risky (YIP mag Dec 2014): High leverage, high risk is the usual mantra. But as Jeremy Sheppard explains, there is actually a case where higher leverage means lower risk. This article goes through the topics investors should consider with mortgage choices. After reading this article you'll see that a low interest rate is not such an important feature. The article focusses on how the investor's strategy dictates the choice of mortgage. |

||||||||

|

|

||||||||

|

What causes price growth (YIP mag Dec 2011): There are loads of differing opinions on the best research to do to find future price growth. But all experts agree on one thing: it all comes down to supply and demand. In this article Jeremy Sheppard shows how investors can quickly gauge the supply and demand for a suburb. He mentions a few of the readily available key statistics and what they mean. If the investor wants to pursue it further, Sheppard offers a few tips on some simple extra research. Obviously there is a lot more to it. But these are the 'quick wins'. |

||||||||

|

|

||||||||

|

When to sell (YIP mag Feb 2014): Should I sell? It's a complicated quetion to answer because of so many variables. Jeremy Sheppard simplifies the concept and shows how you can make a clear objective decision. It all comes down to recycling cost versus opportunity cost. If one is significantly bigger, you have a clear decision. This article provides examples of how to estimate recycling and opportunity costs. Once done, investors can have peace of mind knowing they've made a well calculated decision. |

||||||||

|

|

||||||||