3 reasons to research AFTER you've bought

| Topics: | Supply and demand, Property data, Investment research, Monitor, Worst mistake, Capital growth, Market peak, Vacancy rates |

| Author: | Jeremy Sheppard |

| Date: | 4 Aug 2015 |

Most investors stop suburb research once they've bought. But the need to make good decisions extend into the period of ownership. There are 3 reasons why you need to keep your eye on a market even after buying there:

- Knowing the best time to sell - even if you never intend to

- Knowing the best time to refinance

- Knowing the best time to offer a lease renewal

When to sell - if ever

My worst mistakes in property investing were not selling when I should have. The "never sell" philosophy was drummed into me as a noob by well-meaning educators.

I've bought multiple properties that have doubled in value in 3 years purely from capital growth. That's with no renovation, subdivision, development or any other value adding strategy. It was just pure "sit on your hands" and collect capital growth.

I definitely got my research methods right. But I stopped my research once I had bought, believing I would never need to sell - just keep buying. But corrections invariably happen following fantastic price growth.

Ouchy lessons like that have taught me that there are definitely occasions when an investor needs to sell. So how can we know when it is time to sell?

Recycling costs vs opportunity costs

The decision to sell is actually a rather simple one from a strict investment perspective:

If the cost of recycling equity is less than the opportunity cost, then sell.

The tricky part is estimating the opportunity cost.

What is recycling equity cost?

When you sell one investment property and use the proceeds to buy another, you're recycling your equity. There are costs involved. The big ones are usually:

-

Exit costs

- Capital Gains Tax

- Agents commission

- Legal fees

-

Entry costs

- Stamp duty

- More legal fees

- Building and pest inspections

What is opportunity cost?

If you have $100 invested in an interest earning account at 3% pa but there is another account which could earn you 4%, then the opportunity cost of not switching is $1 pa. 4% minus 3% equals 1%. $100 x 1% = $1.

In other words, opportunity cost is a measure of the cost of missing out on a better investment elsewhere because your funds are tied up in an inferior investment.

More?

For more detail on the topic of recycling equity versus opportunity cost, see this article - "To sell or hold?"

Estimating capital growth

The big issue with calculating opportunity cost is estimating the capital growth of your current investment and that of your new investment.

I deal in capital growth every week. I've examined literally millions of data points. But I'm still not game to publish a prediction of growth with confidence. There are still too many variables to risk advising an investor with a precise figure.

But I'll take a punt estimating future growth for my own portfolio. I need to - how else can I calculate opportunity cost?

Invaluable in this aspect is the Demand to Supply Ratio (DSR). I use the DSR to gauge when demand is ahead of supply for a suburb. It's a pretty easy indicator to read since it is a score out of 100.

I'd expect DSRs in the 80+ range to have double digit growth in the next 12 months. These are markets in which demand is outpacing supply by an impressive degree.

I'd expect DSRs below 50 to have growth around 6% at most. These are markets that are, at best, in balance.

For a DSR between 50 and 80 I apply a sliding scale to estimate growth somewhere between 4% and 10%. About an extra 1% growth for every extra 5 points of DSR. But remember, these are guesstimates.

If the next investment opportunity is estimated to achieve 15% growth and my current investment only 2% growth, then I may decide to sell. But if recycling costs came in at 13% or higher, I wouldn't bother.

As you can see, you really need to be confident of future capital growth to make a good decision. Smart data is crucial.

When to refinance

If the recycling costs outweigh the opportunity costs, then I won't sell. But I may refinance.

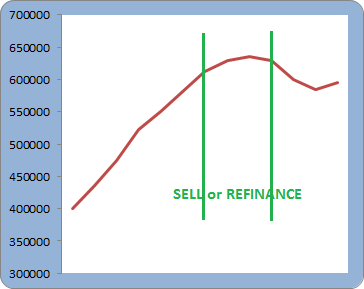

Ideally, I refinance whenever I have enough equity to invest again (and sufficient cash flow). But another good time is when the market is reaching its peak - even if I don't plan to buy again straight away.

Let's say you have a $500,000 property that has $100,000 equity. The market it is in may reach a peak and fall back by $25,000. Risk of that kind of correction is not enough reason to sell, but refinancing before the drop will maximise your equity out.

There are 3 indicators I use to try and gauge the peak of the market:

- DSR - Demand to Supply Ratio

- MCT - Market Cycle Timing indicator

- Typical Values

If an historical chart of typical values shows strong price growth slowing, I might be inclined to think the peak is coming. But there are better indicators.

If the DSR has come down from an above average figure to a balanced figure around 50 or less, then there is little pressure on prices to experience further growth. This is the best indicator I have.

The MCT is an additional indicator. It tries to score the likelihood of a property market being at the start of its next growth phase based on past growth. The MCT will score lower if there has been significant growth recently. So if it is a low score (out of 100) I'll be more confident the bull-run is over.

When to re-let

If vacancy rates are climbing, you might like to lock in your current tenant with a longer lease. You can offer an extension to the lease any time. You don't have to wait till the end of the current lease.

The tenant may not have access to the data you do. So offering a discount or longer security might seem like a great deal to them. But if vacancy rates are climbing, you'll be the one with the best deal.

Good data is vital for making decisions. Whoever has the best data definitely has the edge.

It's all too much trouble

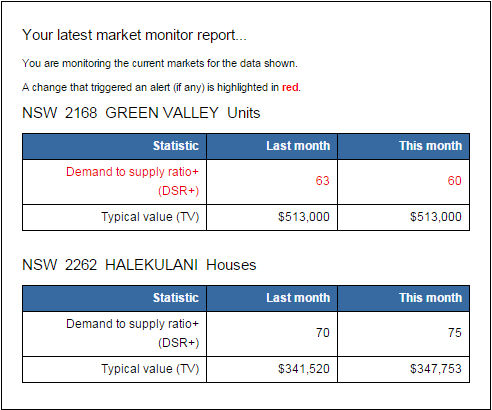

It's a lot of effort to keep your eye on all these indicators. And it's easy to forget to check them every now and then. That's why I created the Market Monitor.

The Market Monitor sends me an email every month with the key indicators I specified for the suburbs of my choice. To grab my attention the monitor's report highlights in red any statistic that has risen above or fallen below some threshold I get to choose. Pretty cool huh.

Conclusion

You don't need the Market Monitor to keep an eye on markets you're exposed to. But intelligent data and hi-tech tools do make it a lot easier. Keep making good decisions and good results should keep coming.

From here: