What's your time worth?

| Topics: | Warren Buffet, Supply and Demand, Hot markets, Capital growth, DSR |

| Author: | Jeremy Sheppard |

| Date: | 19 Oct 2015 |

Warren Buffet is not God. He is a human that makes mistakes like the rest of us. I know this will outrage some of his believers. So this blog is not for them. It is for those who have learnt to think for themselves rather than follow like sheep.

A lot of investors take what Buffet says to be gospel, to be unquestionable. But property investors need to remember that shares are a very different investment vehicle to real estate. You can't just take a buffet-ism from straight out of the stock market and apply it in blind faith to your property investing.

Be fearful... be greedy

One of Warren Buffet's famous quotes is:

"Be fearful when others are greedy and greedy when others are fearful"

The idea here is to go against the heard. The implication is that the heard is buying at the peak of the market and selling at the bottom. But there are a few issues with this one-liner, especially when applied to property...

Percentage Sales Growth (PSG)

For every buyer there must be a seller. So how do you know if the "others" he is referring to are buying or selling? Aren't there both?

Many property investors look for an increase in the number of sales over the year as an indicator of future capital growth. DSR Data publishes such an indicator called the PSG - Percentage Sales Growth. It is the change in sales volume of the last 12 months expressed as a percentage. But it is published by DSR Data with a warning.

A few snippets from the full page which explains the PSG are:

- Increased sales volume is NOT necessarily a big indicator of capital growth potential

- It can potentially lead investors into a trap - especially if used in isolation

- There are cases when a high change in sales represents potential over-supply

- When a new estate is opened in a suburb, extra stock comes onto the market

- Supply is the enemy of capital growth

Who are the "others"?

What if I saw "others" selling, then according to Buffet I should do the opposite right? So I should buy. But what if the "others" I witnessed selling were Buffet and his followers?

How can we distinguish between the heard and the experts?

In the share market, the big trades are made by fund managers buying or selling millions. Mum and Dad investors are like a spec of sand. Mum and Dad investors also lack the professional training and experience of the big fund managers.

So if you watch what is happening in the share market, are you watching the heard or the experts?

This leads to one of the big differences between property and shares - who the "heard" is and how to beat them.

Property is not just for investors

Share price movements are determined entirely by investors. Property prices on the other hand, in the vast majority of markets, are determined by people who just want somewhere to live.

In fact, this is why it is so much easier for property investors to beat average property growth rates. You're not competing with professional investors like in the share market - you're competing with Mums and Dads or young home leavers, retirees, etc.

Admittedly, there are some markets like mining towns where the majority of owners are investors. In these isolated case, you are competing with other investors rather than M & Ds.

When shown a chart comparing property growth to share growth, ask yourself how easy it will be to beat the share index growth rate (the fund managers). Then ask yourself how easy it will be to beat the M & Ds of property.

Beating the averages

While I'm on this topic, there's something I find annoying about charts comparing the performance of the All Ords Index or ASX200 with the national property growth rate. If a stock goes belly up, it ceases trading and is removed from the index.

The value of the share doesn't go from $2.36 to zero. That would bring the performance of the index down. Instead, the share is simply no longer considered in the index.

Property on the other hand doesn't go away. It is never taken out of the index. If it underperforms, it's still included in the national average growth rate. So share market indices are biased a little higher than they ought to be.

Property is a slow mover

Property prices are a very slow moving beast. Trades on the share market can be initiated and completed within a minute. Of course research prior to the trade may have been conducted over weeks. But the feedback the public see as a result of those decisions is very quick.

In property however, the time between a contract "going unconditional" and settling is typically 4 to 6 weeks!

Perhaps that's why in the share market it pays to think counter-cyclical. Perhaps if you go with the trend, you'll be too late. Not so with property...

Perth for example

I've heard plenty of talk recently from no-names that Perth is apparently the place to be buying in late 2015. Some of these no-names are developers of course, trying to flog off their stock. A lot of the argument they put forward is based on Perth having hit the bottom of the market.

But there could be more falls to come. We only know the bottom in hindsight. And the bottom in real estate can last a very long time - it's a slow moving beast.

Who wants to hold a mortgage for a year paying interest without getting any growth? But a year is a relatively short time in property.

There may be some markets in Perth that outperform the city's average growth rate over the next few years. But the city in general is not the best place to buy right now. Simply being at the bottom is not a good enough argument to buy there - even if it is the bottom.

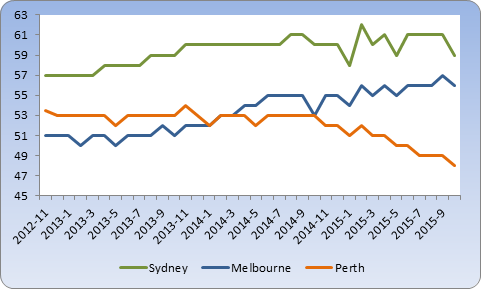

Chart 1 shows the average demand to supply ratio (DSR) for Sydney, Melbourne and Perth over the last 3 years.

Chart 1 - City DSRs for last 3 years to November 2015

DSR stands for Demand to Supply Ratio. Note that the DSR in this chart is not the basic DSR comprising 8 statistics but is actually the DSR+. The DSR+ is a combination of 17 indicators of supply and demand. Obviously the higher the demand relative to supply for a market, the more pressure there is on the future to roll out price growth in that market.

The DSR+ is scored out of 100. The following graphic shows the DSR+ for an ordinary property market. Note the average and median DSR+.

Chart 2 - Coolangatta Units

%20OCT-2015.png)

At the time of writing a DSR+ around 53 or 54 is typical Australia-wide. A DSR+ around 50 is a market in balance. So you can see that most markets are in balance.

However, referring to Chart 1, Perth as a whole city has a falling DSR. Melbourne's DSR+ is rising and Sydney's DSR+ has certainly levelled off and might even start falling.

What does it all mean?

If there was a real estate index for each capital city, my money would still be on Sydney - even at the end of 2015. But if the trend of Melbourne DSR continues, then eventually I might dump Sydney for the Melbourne index. One thing is for sure, I certainly wouldn't be buying the Perth index right now.

And lastly, share market wisdom may not readily apply to Australian property investing. Apologies to Buffet worshippers - he is still the top dog though.

From here: