Yield

What is the yield?

The yield is a measure of how much rental income a property earns in one year calculated as a percentage of the property's value.

There are 2 kinds of yields you'll hear about: gross yield and net yield. The gross yield is most often quoted and is easily calculated. For example, if the rent charged to live in a property is $300 per week and the value of the property is $400,000 then the gross yield will be $300 x 52 weeks ÷ 400000 x 100 = 3.9%.

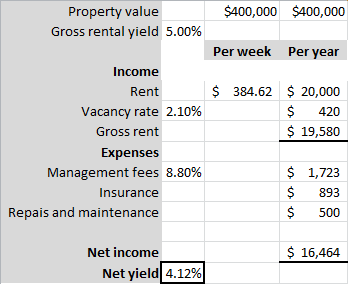

The net yield is much more important but not nearly as easy to calculate and therefore less often quoted. A very simple net yield calculation for an imaginary property is shown in table 1.

Table 1 - Simple net yield calculation.

Note that mortgage interest and tax aren't usually considered in the calculation of net yield. This is because these are largely up to the circumstances of the owner and aren't related to the property itself.

When selling a property, the current owner may know nothing about the potential buyer's circumstances. So they advertise details about the property in isolation.

You should however include mortgage interest and tax in your calculations of return on investment. You should also consider depreciation, land tax, stamp duty, mortgage insurance, etc.

Why is the yield important?

A high yield means good cash flow for investors improving their return on investment. Good cash flow makes it easier to get loans approved to purchase more property. That's all good and well, but the reason why the yield is included as one of the variables that make up the DSR is because it is a pre-cursor of capital growth.

Which is easier, getting a lease or getting a mortgage? Clearly, it's easier to get a lease. So it is easier to move if you're a renter than if you're an owner-occupier. This means tenants are more agile than owners. So when a location becomes attractive, renters are the first to make a move on it.

A location may become attractive because new businesses open in the area providing employment opportunities. Or perhaps a new train station is built, or perhaps other areas have simply become too expensive. Whatever the reason, it is the renters that are likely to get there first. They increase demand for rental accommodation and this places pressure on rents to go up. But since they don't buy, the property prices aren't under the same pressure - only the rents go up. This increases the yield.

Investors may notice that the yield in these attractive locations is higher than in other areas. This will attract them into the market once renters have had their influence.

If renters find a location attractive, it is rarely the case that owner-occupiers will not. Both demographics are human and look for similar qualities. So with renters demanding accommodation, investors buying and eventually owner-occupiers buying, prices are more likely to go up. But the lead indicator was the yield.

Note that yield may not always be a lead indicator of capital growth. Some investors focus purely on the yield without any consideration of how the yield got so high. It is possible that the yield rose not because of increasing rents, but because of falling property prices. A quick check of what rents and property prices were a year ago will protect you from this trap for novice investors.

It is possible to have high yields in locations dominated by renters but where owner-occupiers are reluctant to buy. An example of this is a location with a heavy concentration of housing commission homes. Mining towns are another example. People have to live there to work there, but they don't want to be there forever, so they rent rather than buy. Once the yields get truly high, the majority of price pressure comes from investors in these locations rather than owner-occupiers.

In summary, a high yield represents a keen interest from renters compared to the interest from owner-occupiers. The question is: will that keen interest migrate to the minds of buyers as well? Quite often it does.

Is the yield reliable?

The gross yield is one of the most unreliable statistics commonly quoted about property markets. The reason why is because both variables needed to calculate it are highly susceptible to statistical anomaly. One statistical anomaly multiplied by another can result in an exponentially unrealistic figure. This is especially the case where there are multiple markets within a market, like where there are two house markets in the one suburb, new and old for example.

For example, there may be a suburb with old 2 bedroom single storey fibro houses worth $200,000 that rent for $200 per week. And the same suburb may have brand new 4 bedroom double storey full brick houses renting for $400/wk. One month three houses sell: two of them are the old fibro houses and one is a new brick house. So the median is $200,000.

The same month 3 leases are signed: two of them to rent the 4 bedroom brand new houses and one lease for a fibro. So the median rent for that month was $400/wk. The yield for that month was therefore over 10%. That's $400/wk median rent versus $200,000 median value.

But let's say that next month more new houses sold than old houses. So the median rose to $400,000. This is not 100% capital growth in one month - it's a statistical anomaly. The same month, more fibros rented than new brick houses. So the median rent was only $200/wk. This is not a 50% drop in rents - it's a statistical anomaly. The yield for that month was therefore a little more than 2.5%. That's $200/wk median rent versus $400,000 median value.

The yield figures will become unreliable in any of the following circumstances:

- There are very few properties selling in order to gauge an accurate typical value for properties, for example, less than 4 a month.

- There are very few properties for sale in order to gauge how much they might sell for, for example, less than half a dozen properties on the market.

- There are very few new leases being signed in order to gauge an accurate typical weekly rent, for example, less than 4 a month.

- There are very few properties advertised for rent in order to gauge how much they might rent for, for example, less than half a dozen properties on the market.

- There is a significant difference between the same property types. For example new houses, versus old houses are very different. Or a vastly different street within the same suburb, or large blocks versus small blocks or houses with 5 bedrooms amongst those with only 2.

You can always verify the gross yield yourself. Check out the type of properties being rented against those being sold.

Given how often the gross yield can get unrealistic, it really is important to validate this yourself before basing any investment decisions on it. Use the vacancy [LINK TO /stats/vacancy] and rental growth [LINK TO /stats/rent_growth_perc] to further your protection.

What is a good yield?

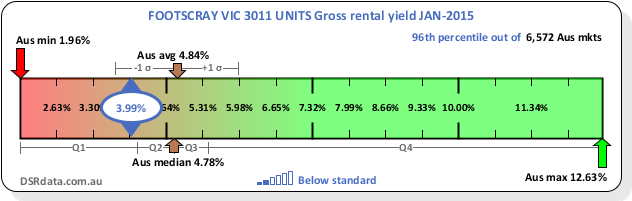

The following context ruler shows the yield for units in Footscray in January 2015.

As you can see from the Context Ruler, a yield of around 4.8% was pretty normal in January 2015 around Australia.

You can find the best markets by yield using the Market Matcher.

Base data and other sources

Some alternative sources for this kind of data include: