Percentage Stock on Market

What is the SOM%?

The SOM% is the percentage of stock on market. For example, if there are 1000 properties in a

suburb and 10 of them are currently listed for sale, then the SOM% is 1%.

Why is the SOM% important?

The SOM% is a supply indicator. The higher the SOM the more supply. Supply

is the enemy of demand, so it makes sense

that for capital growth to occur you want to find properties markets with low SOM% figures.

The SOM% for a property market is scored and that score is included in the calculation of the

DSR+.

Is the SOM% reliable?

The SOM% can become misleading if the number of properties in a market gets out of date.

A quick check on a property listing portal will give you the number of properties for sale.

But then you need to estimate the number of properties in the suburb.

You can use a satellite mapping tool like Google to get an estimate for the property count in a suburb.

This is a rather inaccurate means of counting however,

since some properties look like one but are actually two or more.

And some properties are commercial/industrial.

Another common problem with the stock on market calculation occurs when a developer releases a block of apartments.

The listing agent may advertise only a single 1 bedroom, 2 bedroom and 3 bedroom unit as samples.

But the project may actually contain a total of 50 units.

When performing your statistical due diligence check if the SOM% is under-quoted.

Browse the properties listed for sale in any one of the popular listing websites to find developer projects.

Then contact the developer or listing agent to get a complete count of dwellings in the project.

Pay careful attention if there are "staged releases".

Find out numbers and dates.

Sometimes an agent may have been allocated only 20 dwellings to sell out of a much larger project.

What is a good SOM%?

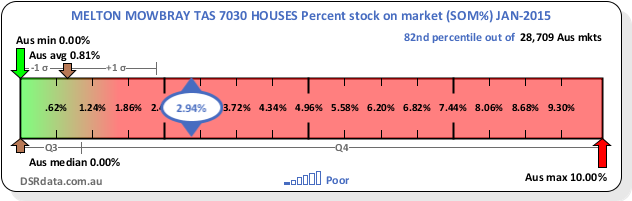

The following context ruler shows the SOM% for Melton Mowbray houses was 2.94% in January 2015. The chart also shows a range of possible, likely and typical SOM% values.

As you can see from the Context Ruler, an SOM% of under 1% was pretty normal in January 2015 around Australia.

You can find the best markets by SOM% using the Market Matcher.

Base data and other sources

Some alternative sources for this kind of data include: