Online Search Interest (OSI™)

What is the OSI?

The OSI stands for Online Search Interest. The OSI is a ratio of the number

of people searching online for property versus the number of properties available for sale.

For example, if there are 10 properties listed for sale in a suburb and there have been 200 people

searching for property in that suburb, then the OSI is 20.

Why is the OSI important?

The OSI pitches demand from would-be buyers against supply of properties for sale. Prices go up when demand exceeds supply. So a high OSI is an indicator of price growth. The higher the OSI the more pressure there is likely to be on prices to go up.

The OSI for a property market is scored and that score is included in the calculation

of the DSR+.

Is the OSI reliable?

The OSI can be unreliable depending on how the count of people searching is performed.

If a person re-visits a property 3 times in the one week, the property portal will probably count

that as 3 different people.

Not being able to distinguish between a new visitor and the same visitor can exaggerate the count. However,

if the same person returns multiple times to the same property or the same suburb, it does kind of gauge

their level of interest as being higher than a person who has a look and moves on. So even though the figure

may be exaggerated, it is not that misleading in gauging demand.

To truly check how much interest there is for property, turn up to the open inspections and take a quick count.

Looking online doesn't require the same commitment as actually turning up. So you'll get a

better gauge being there.

What is a good OSI?

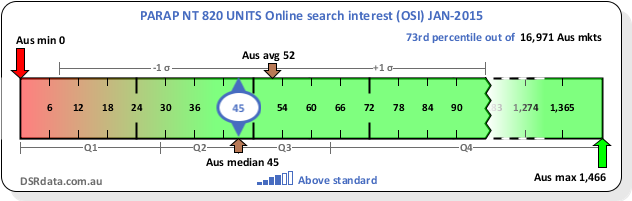

The following context ruler shows the OSI for Parap units was 45 in January 2015. The chart also shows a range of possible, likely and typical OSI values.

As you can see from the Context Ruler, an OSI of 50 was pretty normal in January 2015 around Australia.

You can find the best markets by OSI using the Market Matcher.

Base data and other sources

Some alternative sources for this kind of data include: