Market Cycle Timing (MCT™)

What is the MCT?

MCT stands for Market Cycle Timing. The MCT is a score out of 100 for the likelihood that a market

has just entered a new growth phase.

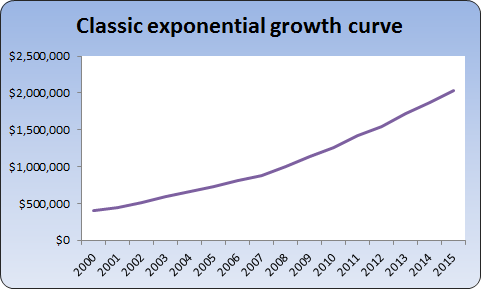

Property markets rarely grow gradually following a smooth stereo-typical exponential

curve as shown below.

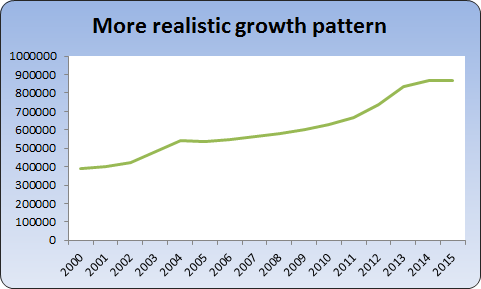

Property markets usually have a relatively short surge of growth followed by a longer period of relatively flat growth.

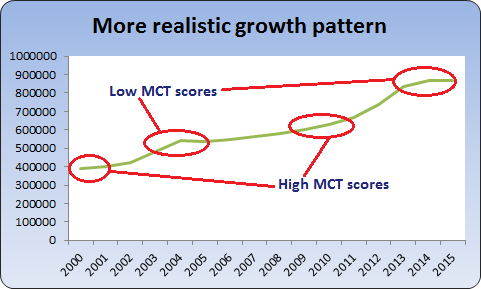

The longer the period of below average growth, the more likely

the following surge will be above average and therefore the higher the MCT

will be.

However, the MCT also considers recent growth and it does so in

the opposite direction. The worse the very recent growth is, the lower

the MCT score will be.

So the MCT looks for both low long term growth AND high recent growth.

This means the MCT is rigged to score markets highly if they have just

entered their next growth surge.

Why is the MCT important?

The MCT can be used to time entry into a market. But it can also protect

investors from entering a market that may have already reached its peak for a long while.

The MCT is one of the most vital statistics incorporated into

the DSR+.