Auction Clearance Rate

What is the ACR?

The ACR, or Auction Clearance Rate, is the number of properties

that sell as a percentage of

those that go to auction.

Not every property that is placed on the market via auction sells.

Some auctioned properties are passed in.

This means that the seller was unwilling to part with their property

for the amount offered by the highest bidder.

Or perhaps there were no bidders.

Properties for auction can also be withdrawn. This may be from a

lack of interest from potential buyers.

Properties can also be sold prior to auction. A buyer may not want to risk losing the property to another bidder

on the day. So they may make an offer to the vendor prior to the auction date. Similarly, the seller may not want

to risk poor bidding at the auction. So when presented with a decent offer prior to the auction, they may accept it.

There are also occasions when the property is sold soon after the auction. Perhaps bidders weren't prepared to go that

little bit extra until after they slept on it. Or perhaps the seller reviewed the highest bid and decided to accept it

days later.

The ACR is expressed as a percentage. For example,

if there were 5 properties for sale via auction

and 4 sold and the 5th was passed in, then the ACR would be 80%. That is 4 ÷ 5 x 100.

ACR figures are often provided for entire cities like Brisbane,

Sydney, Melbourne, etc. And they are usually a count

of auctions held over either a month or a week. DSRdata.com.au

provides ACR data at the suburb level and even broken

down by houses or units.

Why is the ACR important?

If there is strong demand for property and limited supply,

buyers will bid the price up at auction.

With higher price bids there is more chance that the seller

will get the offer they want. With more sales,

there will be a higher ACR.

So a high ACR represents a high demand compared to supply. Since

demand and supply are the only factors

affecting price change, you can see that the ACR is an important statistic

for property investors.

How can investors use the ACR?

Checking the ACR should be one of the first things you

research as part of your due diligence. Given how quick and easy

it is you really have no excuse not to.

You can use the Suburb Analyser to check a property market ACR.

You can also search for markets that have a high ACR using

the Market Matcher.

The ACR is used in the basic DSR along with

other stats.

Checking the DSR is an easy way to view a bunch of stats at a glance.

The DSR in turn is considered in DSR+ which

is even more

reliable since it includes even more stats.

Is the ACR reliable?

In short, the answer to this question is, it depends. In general,

the ACR is only an accurate reflection of the demand-supply gap when

the volume of auctions is significant. But when the volume of auctions

is significant there is already an argument for the market being hotter than normal.

Sometimes the state of the market suits auctions as a means to selling a property.

And other times auctions are a bad idea. In general, real estate agents use auctions to

sell property when demand to supply is already quite good. This allows bidders to push the

price up to the maximum.

Also, exclusive properties are often sold via auction. So it is more likely

there will be a higher auction volume in suburbs with higher typical values.

Even if a suburb has a low ACR, if the volume of auctions is high compared to the

number of ordinary sales, it can represent a strong market for sellers and therefore

may signal future price growth. This is because the local agents believe the market to

be more suitable for auctions.

DSRdata.com.au also published

the percentage of sales by auction.

Keep in mind that the more auctions that are conducted in a suburb, the more likely one of them will be passed in.

This will bring the ACR below 100% even if there is very strong demand and low supply. The best chance of seeing

an ACR of 100% is when there is only one auction.

If you could rate every suburb in Australia by recent ACR,

you will find that all the top ACR scoring suburbs have an auction clearance

rate of 100%. This may not mean a hot market though. It could be that there was only one sale.

And that may have been a deceased estate or mortgagee repossession where the vendor is not too

concerned about the result so long as there is a result.

Similarly, if the ACR is 0% this doesn't mean that the market is cold. It is more than likely that

there was only one auction and it was passed in or withdrawn. So the auction clearance rate is dependent

on auction volumes for accuracy and the larger the volume, the more likely the market is already reasonably hot.

In general you should be sceptical of both 0% and 100% ACR figures until the number of auctions held can be determined.

At least half a dozen auctions would be required to

consider the ACR as reasonably reliable.

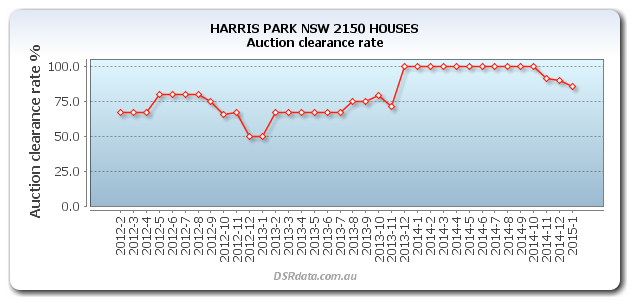

It's worthwhile checking historical figures in case this stat has volatility or quiet months. You can easily do

this by clicking on

the historical chart button in the Suburb Analyser.

Clicking on the Historical Chart button will show you the history of the statistic

for your market of interest over the last few years. An example follows.

What is a good ACR?

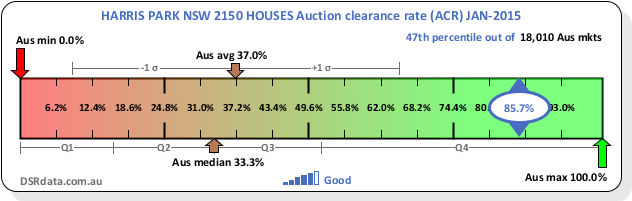

You can click on the context ruler to get an

idea of what is a good value for this statistic.

![]()

The following context ruler shows the ACR for Harris Park houses for January 2015 was 87.5%. The chart also shows a range of possible,

likely and typical ACR values.

As you can see from the Context Ruler, an ACR of around 90% was pretty good in January 2015 around Australia.

You can find the best markets by ACR using the Market Matcher.

Base data sources

Some alternative sources for this kind of data include: